Pages

▼

Tuesday, 23 April 2013

Tax Haven? No Contract

The message proffered by David Cameron when he spoke at the World Economic Forum in Davos was tax avoidance would become a priority of the UK’s presidency for this year. In reality, the government acts in the opposite manner, rewards those companies who channel money to tax havens with further contracts paid for by the taxpayer.

The calls for the government to bring about an end to tax havens has continued to grow ever louder as the general public observe the stripping of the welfare state, whilst billions of pounds exits the county into offshore accounts. Many of these companies are in receipt of taxpayer’s money, which are handed contracts by cash-strapped councils who continue to work with the organisations despite their dubious tax practices.

Take Telereal Trillium, responsible for a £3.2bn 20-year deal to manage and provide property services for the DWP offices. Through a complex network of accounts, the group of companies have channeled over half a billion pound through a complex series of accounts via a company based in the British Virgin Islands. Now aside from the fact that one of the directors linked to the Bermuda trust part-funded David Cameron’s leadership campaign in 2005 with two £10,000 payments, they are an approved bidder for MOD contracts worth up to £4.35 Billion.

Care UK, which operates across large areas of the NHS is according to non-profit research project Corporate Watch, reducing its tax liability by routing £8m a year in interest payments on loan notes issued in the Channel Islands. Care UK, who through their former chairman John (now Lord) Nash funded Andrew Lansley’s office when he was shadow health secretary to the tune of £21,000. Care UK, who through Harmoni are the largest provider of Out of Hours service have come in for consistent criticism, yet none of this halts their expansion fueled by the general public.

Circle Health who have Conservative MP Mark Simmonds as an adviser, is owned by companies and investment funds registered in the British Virgin Islands, Jersey and the Cayman Islands. The reward for this was for them to become the first company to run a NHS hospital.

Ramsay Health Care, Australia's biggest private hospital chain, bought Capio UK in 2007, acquiring hospitals and nine Independent Sector Treatment Centres for NHS patients. Ramsay according to Corporate Watch now has ‘22 hospitals across the UK and almost 60% of its work is from the NHS.’ Ramsay has the largest amount of healthcare provision contracts in the NHS, and used a subsidiary in the Cayman Islands to finance the purchase of a French health company for its Australian parent company. This is important for they ‘borrowed £57m from RHC Finance Ltd, a subsidiary of its Australian parent registered in the Caymans, to finance the acquisition of a 57% share of the Proclif Group, re-branded as Ramsay Sante, a leading French private healthcare company. This led to £1m leaving the UK for the Cayman Islands in interest payments.’ According to a Guardian report Ramsay Health Care is the third biggest supplier to the NHS receiving £30 million in revenue in 2010/2011.

In written evidence given to the treasury in 2011 on Private Finance Initiative, Dexter Whitfield, the Director of European Services Strategy Unit revealed an increasing number of PFI projects registered in tax havens. Equity in 91 PFI projects is owned by secondary market infrastructure funds located in tax havens. These include HSBC Infrastructure in Guernsey, John Laing also in Guernsey and Venture Capital company 3i, who are in Jersey.

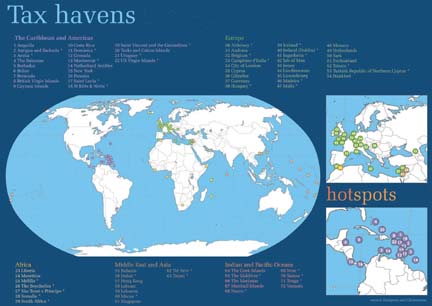

Research conducted for Tax Justice Network by James Henry, a former chief economist at the consultancy McKinsey, estimated that at least £13 trillion is hidden in offshore accounts by the year 2010. The government is of course aware of the behaviour of these companies; after all they created the system that allows it to take place. As the Tax Justice Network put it: ‘Tax havens and offshore financial centres have created an interface between the illicit and licit economies, corrupting national tax regimes and onshore regulation.’

The government’s response to tax havens has been pathetic and as far as the HMRC goes, they have weakened the organisation in terms of staffing. In addition, the Conservative special adviser and former corporate tax lawyer Edward Troup has been placed in charge of tax at HMRC. He is supported by Ian Barlow who was the former senior partner at KPMG who were fined $455 million a few years back for tax abuses. Furthermore the HMRC ethics committee is chaired by Phil Hodkinson, who is a director of the Resolution insurance company based in a tax haven.

The ultimate aim ought to be the end of tax havens, a unified tax that prevents competition and halts the harmful race to the bottom. In the meantime while this battle continues, there is one action the government can take to force companies to change their tax habits and perhaps for a campaign to be started?

Any company who has a tax haven in any part of their organisation will not be allowed to participate in any bid for a contract funded by the taxpayer. The government themselves won’t do this without pressure because they are funded by the City, who are the worst offenders of them all. However, now that they have decided to make this the main topic of the G8 presidency, then now is an ideal time to get them to justify why they pay taxpayers money in their droves to companies who avoid tax, whilst the welfare state burns.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.